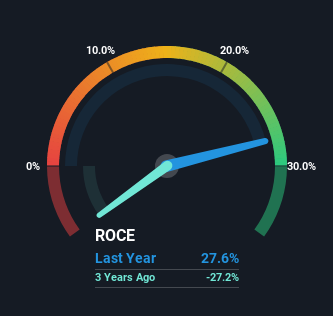

If you’re not sure where to start when looking for the next multi-bagger, there are a few key trends you should watch out for. Among other things, we will want to see two things; first, growth back on capital employed (ROCE) and on the other hand, an expansion of Rising capital employed. This shows us that it is a capitalization machine, capable of continually reinvesting its profits into the business and generating higher returns. So when we looked at the ROCE trend of Sunlands Technology Group (NYSE:STG) we really liked what we saw.

What is return on capital employed (ROCE)?

For those who don’t know, ROCE is a measure of a company’s annual pre-tax profit (its return), relative to the capital employed in the company. Analysts use this formula to calculate it for Sunlands Technology Group:

Return on capital employed = Earnings before interest and taxes (EBIT) ÷ (Total assets – Current liabilities)

0.28 = CN¥366 million ÷ (CN¥2.2 billion – CN¥828 million) (Based on the last twelve months to September 2024).

SO, Sunlands Technology Group has an ROCE of 28%. In absolute terms, this is an excellent return and is even better than the Consumer Services sector average of 9.2%.

View our latest analysis for Sunlands Technology Group

While the past is not indicative of the future, it can be useful to know a company’s historical performance, which is why we have this chart above. If you want to know the past performance of Sunlands Technology Group in the past with other indicators, you can check this free chart of Sunlands Technology Group’s past earnings, revenue and cash flow.

What can we say about Sunlands Technology Group’s ROCE trend?

We are delighted to see that Sunlands Technology Group is reaping the benefits of its investments and has now managed to become profitable. Historically, the company generated losses but as the latest figures cited above show, it now earns 28% on its capital employed. When it comes to capital employed, Sunlands Technology Group is using 24% less capital than it was five years ago, which at first glance may indicate that the company has become more efficient at generating these returns. The reduction could indicate that the company is selling some assets and, given that yields are rising, it appears to be selling the right ones.

Along the same lines, the company’s ratio of current liabilities to total assets has decreased to 38%, essentially reducing its financing from short-term creditors or suppliers. Shareholders would therefore be happy if the growth in returns comes mainly from underlying company performance.

The key to remember

In a word, we are happy to see that Sunlands Technology Group has been able to generate higher returns with less capital. Although the company may be facing problems elsewhere since the stock has plunged 77% over the past five years. Still, it’s worth doing further research to see if the trends will continue in the future.

One more thing to note, we have identified 2 warning signs with Sunlands Technology Group and understanding them should be part of your investment process.

If you want to research more stocks that have generated high returns, check out this free list of stocks with strong balance sheets that also generate high returns on equity.

New: Manage all your stock portfolios in one place

We created the ultimate wallet companion for stock investors, and it’s free.

• Connect unlimited wallets and see your total in a single currency

• Be alerted to new warning signs or risks by email or mobile

• Track the fair value of your shares

Any feedback on this article? Worried about the content? Get in touch with us directly. You can also email the editorial team (at) Simplywallst.com.

This Simply Wall St article is general in nature. We provide commentary based on historical data and analyst forecasts only using unbiased methodology and our articles are not intended to constitute financial advice. It does not constitute a recommendation to buy or sell shares and does not take into account your objectives or your financial situation. Our goal is to provide you with targeted, long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.