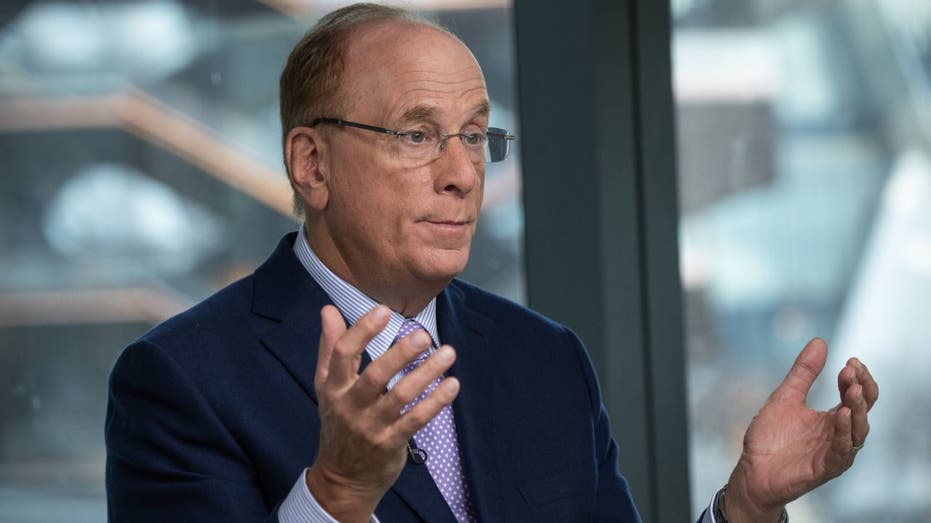

The president and chief executive officer of BlackRock, Larry Fink, gives his point of view on tariff negotiations with China and the volatility of the market on “the countdown of the Claman”.

The 60/40 portfolio, bond shares has long been the proven method for those who build their pension nest eggs with a diversification safety net. But times, they are changing and the CEO of Blackrock, Larry Fink, advises a makeover.

“The generations of investors have managed to follow this approach, having a mixture of the entire market rather than individual titles. But as the global financial system continues to evolve, the classic 60/40 portfolio may no longer fully represent diversification. Fink wrote in his 2025 letter to investors.

The annual letter of the CEO of BlackRock, Larry Fink, to investors

Larry Fink, president and chief executive officer of Blackrock Inc., Right, and Adebayo Ogunlesi, President and Chief Executive Officer of Global Infrastructure Partners (GIP), during a Bloomberg television interview in New York, United States, Friday, January 12. (Photographer: Victor J. Blue / Bloomberg via Getty Images / Getty Images)

In the case of infrastructure, Fink praised its characteristic of inflation protection; Generation of income from payments, stability vs volatile public procurement and solid yields with even 10% of the allowance, he noted.

Blackrock recently paid $ 23 billion for the Panama Canal ports. For example, income can be generated by invoicing ship fees to go through the waterways.

Blackrock pays $ 23 billion for ports of the Panama Canal

| Teleprinter | Security | Last | Change | Change % |

|---|---|---|---|---|

| Blk | Blackrock inc. | 875.75 | +9.64 |

+ 1.11% |

Even if Blackrock, with more than 11 billions of dollars in active is the largest asset manager in the world, a 50/30/20 mixture or another split with alternative assets, can be logical for smaller retail investors.

Katie Klingensmith, chief investment strategist at Edelman Financial Engines, shares her point of view on the benefit of the diversification of private investments.

“For someone who has a lot of time in front of him and has the assets to justify an allocation to the private people, we believe that it is a really exciting opportunity because of the diversification that it provides to a portfolio”, Katie KlindensmithThe chief investment strategist at Edelman Financial Engines, told Fox Business.

Mortgage rates increase in the midst of market volatility

“From our point of view in general, when we think of building these really robust portfolios for our customers, but when we also think of what we think is the best for the majority of investors who are not necessarily an ultra-elevated net value.

THE S&P 500, the widest measure on the US stock markethas lost 10% this year.

Get Fox Affairs on the move by clicking here

The US Core Bond index of Morningstar increased by around 2% this year. It measures fixed rate securities and investment investment level with deadlines over one year, according to the firm.