While we continue our conversation with Tracy DavisA tax technology expert at Thomson Reuters, she shares big ideas on how Tax technology managers Can team up with other departments to align technological projects with larger commercial objectives. It also plunges into best practices for the integration of tax technologies, how to stay up to date with the latest updates and paints an image of the future workforce.

I would like to hear your reflections on best practices to add new tax technologies to existing systems. In addition, how can tax technology managers help with this process?

Davis: Well, one of the best key practices is to start with an in -depth assessment of needs. You want to make sure that the new technology takes up the specific challenges with which your tax service is faced. It is also important to align these new tools with your wider commercial objectives. You don’t want to implement something that does not get into the situation as a whole.

Involving interfunctional teams, like her and financeis a must. They can help ensure that the new technology is smoothly integrated into your existing systems and can identify any problem of potential compatibility. And when they collaborate with finance, it guarantees that technological investments make sense for the financial and compliance of the company. Regular training and clear communication are also crucial. You want to make sure everyone feels comfortable with new tools and understands why they are important.

Dedicated tax technology managers play a huge role in all of this. They act as the bridge between the tax service and other units, ensuring that the technological solutions are perfectly suited. They can also develop a Strategic roadmap for implementationConfigure measures to follow how the new technology works and direct efforts to continue to improve and adapt as technology evolves.

How can corporate tax professionals remain up to date with the latest trends and innovations in tax technologies, and what resources are available to them?

Davis: Big question! One of the best ways for corporate tax professionals to stay up to date is to engage in continuous learning. For example, assist Industry conferences And webinaries can be very useful. These events are a great way to see what is new and get expert ideas in the field.

Another useful approach is to subscribe to relevant publications. There are many magazines, newsletters and online resources that focus specifically on tax technology. They can help you stay up to date on the latest trends and innovations.

Joining professional organizations, such as the Institute of tax executivesis also a big plus. These organizations offer networking opportunities and educational resources that can be incredibly precious. You can connect with other professionals and learn from their experiences.

Collaboration with technological partners and sellers is another important strategy. They usually have the latest technologies and can tell you about new tools and solutions that could help your business.

In addition, training sessions and regular workshops within your own organization can make a huge difference. These can help you and your team, stay up to date and feel confident using new technologies. Overall, it is a question of remaining committed and proactive in your learning.

What are certain risks confronted if they are faced with the hiring of a tax manager or other hybrid roles? How can they minimize these risks?

Davis: Well, one of the greatest risks is that the tax service could lack a clear strategy concerning technological orientation. Without someone dedicated to this role, you could end up with ineffectiveness and miss opportunities to improve conformity.

To reduce these risks, companies can select someone to guide the technological strategy Within the tax department and create hybrid roles that combine tax and technological skills. In this way, you have team members who include the two areas and can assure you that your technological solutions make sense for the needs of the tax service.

Investing in technological training for tax professionals is also essential. It helps develop the skills and confidence they need to use new technologies. And defining clear success measures can help more effective technological integration, overall improving commercial operations. By taking these measures, companies can reduce potential challenges and make the most of new tax technologies.

With the growing use of advanced technologies in tax departments, how do you see the evolution of tax / hybrid technologies that have an impact on future enrollment?

Davis: In our 2025 Technological report of the corporate tax departmentWe have found that more than half of employers are already hiring hybrid tax / technology roles. This really shows how important technological skills are in the tax profession. I think that this trend will only take a speed, with new roles of use to fill the gap between traditional tax functions and modern technology.

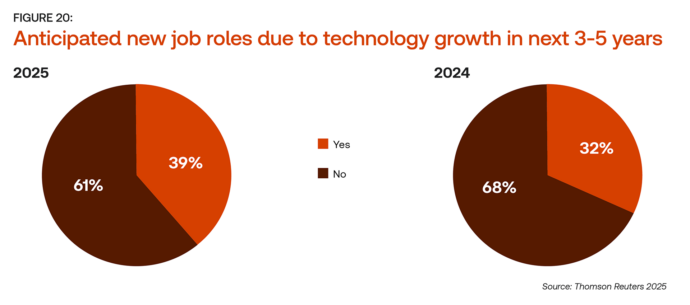

The report predicts an increase of 7 percentage points in the new roles of use and an increase of 14 percentage points of changes in existing roles. This means that tax professionals will have to adapt quickly by accelerating technical skills in parallel with their tax knowledge. This change will probably make the processes smoother processes, will increase precision and improve decision -making capacities within tax services.

Hold your informed team from the latest tax technology trends

While companies’ tax services continue to evolve with advanced technologies, staying up to date and prepared is more important than ever. Our conversation with the tax leader Tracy Davis really returned the importance of collaboration, the adoption of best practices and the increase in hybrid roles in the formation of a strategic and efficient tax workforce.

To better understand these transformative trends and prepare your organization for future challenges, we strongly recommend that you check our 2025 Technological report of the corporate tax department. This report is full of precious data, trends and strategies to help you remain informed of the latest changes in tax technology.