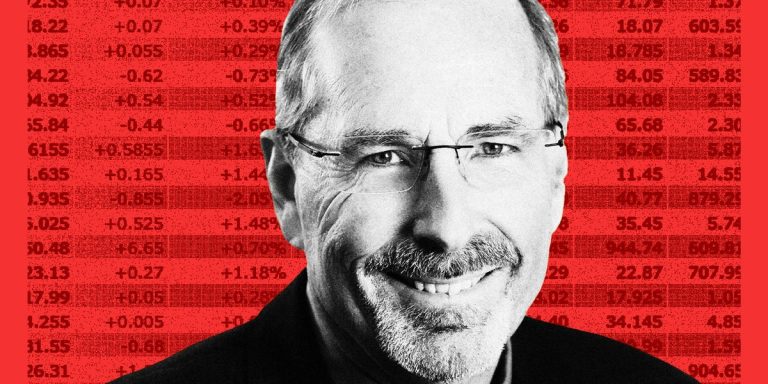

In previous market sales, Bill Smead It would be to lick your chops at the moment, preparing to jump on a reduced price market for which other investors had lost their appetite.

But today, the value investor is not even peckled yet.

“The psychology of the market and the economy is very lower, and it would normally be a reason for us to be very positive,” Smead, founder of Smead Capital Management on Friday. “The problem is that we have to relax the greatest mania in my career.”

Smead began his career in 1980 by negotiating for Drexel Burnham Lambert. He now manages the Smead Value Fund (SMVLX), which has beaten 96% of similar funds in the past 15 years, according to Morningstar data.

To illustrate how pessimistic investors have become in the midst of President Donald Trump’s pricing policies, SMEAD underlined the data from the American Association of Individual Investors, showing that more than half of its members had been lowered for eight consecutive weeks. The most recent edition of Survey on Global Fund managers of the Bank of America Echo the severity of these prospects for slowing down the markets at the moment: the highest proportion of fund managers since 2000 are planning to reduce exposure to actions.

America Bank

But with the market having already undergone a decline of 19%, why does Smead think that the sale has even more possible? He underlined some measures which show an exposure historically high to actions.

One is the assets of household shares as a percentage of household assessments. It was at record heights with the fourth quarter of 2024.

Fed of Saint-Louis

Second, the so-called Warren Buffett indicator of total stock market capitalization compared to GDP is still near recent summits. The ratio should fall to around 80% to reach the same level when Buffett called a background in September 2009, he said. At its extreme stockings in March 2009, the ratio fell to 51%.

Gurufocus

This SMEAD to take place will expect to play some time, he said.

“The market is expected to drop by 50%” to reach an 80% ratio on the short-term GDP market, he said. But “it will probably not accept this short-term ratio. It will be a phenomenon of several years to reach this ratio,” he added.

Recent market volatility has cooled while investors are waiting to see how prices have an impact on inflation and economic growth. Stagflation fears have increased, show it the Bank of America’s Splay Manager Manager Manager, such as prices threaten to hinder growth and increase consumer prices.

America Bank

Smead has warned against a calculation for the market in the past two years. Preparing for a gap of highly appreciated technological actions, he has loaded energy stocks, commercial fri and house manufacturers. This injured him in 2024, when his fund only increased by 3.5%. But he bet that a potential recession will be a boon for petroleum and gas stocks, generally a defensive sector which is now negotiated with cheap assessments after the trade war and production increase the prices landed.

“In the deep recession of ’08, the Americans used 2% less gas than the previous year,” he said.