What this means: The 20% small business deduction is set to expire at the end of the year, causing a massive tax increase on more than 33 million small businesses. NFIB member Alison Couch testified on behalf of small businesses on the importance of making this deduction permanent.

NFIB members take: “I have been practicing public accounting for 21 years and I can tell you without a doubt that the 20% small business deduction is the most beneficial tax deduction for small business owners,” said Alison Couch, president of ‘Ignite Accounting & Business Advisors.

Take action: NFIB’s petition to make the small business deduction permanent has reached 100,000 signatures! Help amplify the voices of small businesses by signing today.

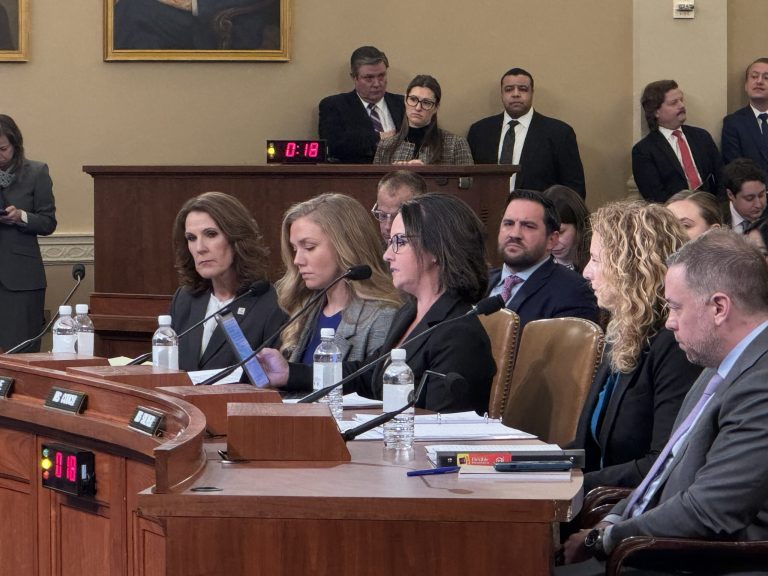

Alison Couch, NFIB member and small business owner of Ignite Accounting & Business Advisors testified at a hearing on the need to put an end to the massive tax hike by making the 20% small business deduction permanent. Alison testified before the U.S. House of Representatives Committee on Ways and Means on January 14, marking her second testimony before the committee.

Alison’s testimony focused on her clients’ lack of certainty about whether the arrangements their small businesses rely on will be extended. “These include the 20% small business deduction and reduced rates for individual income brackets. Additionally, they still face strict regulatory requirements imposed by tax authorities that waste a lot of time and effort,” explained Alison.

Alison urged Congress to act quickly to preserve the 20% small business deduction and reduce the burden on small businesses. Learn more on the benefits of the deduction and updates to the legislation to make it permanent.

ACT: The NFIB’s petition to make the small business deduction permanent has reached 100,000 signatures. Help amplify the voices of small businesses by signing today.