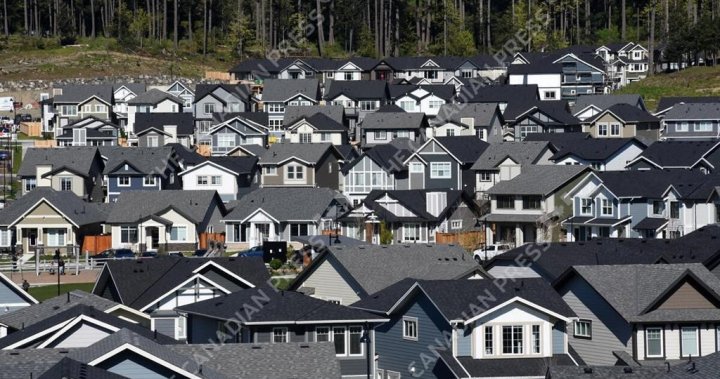

The combination of interest rate cuts and new mortgage rules that come into effect on Sunday are expected to boost B.C.’s growth. real estate sector, analysts say.

Under the new rules, mortgage insurance will apply to homes valued up to $1.5 million.

Previously, any home valued at more than $1 million required a minimum 20 percent down payment.

But starting Sunday, the rules will allow a five percent down payment on the first $500,000 and 10 percent down on the remaining amount up to $1.5 million, leaving qualified buyers with a down payment of $75,000 .

First-time home buyers will also be eligible for a 30-year mortgage.

Get the latest national news

For news impacting Canada and around the world, sign up to receive breaking news alerts sent directly to you as they happen.

British Columbia mortgage broker Angella Calla said the changes are good news for potential buyers.

“It will help those who haven’t had the opportunity to save as much as a down payment, the assured cap will help them get into the market, it will also help those looking to get into the detached home market,” she declared.

“And the 30-year mortgage will help them by allowing them to further ease their cash flow and make it affordable when they enter the market.” »

The new mortgage rules follow 50 basis point reductions in the Bank of Canada’s key interest rate earlier this week and in October.

The combination of reductions and new rules could boost B.C.’s real estate market, which has seen a significant slowdown in the wake of the COVID-19 pandemic, said Randy Ryalls, managing broker at Royal LePage Sterling Realty in Port Moody.

“From April to September, we saw quite low transaction volumes, certainly compared to the pandemic years, where they were off the charts,” he said.

“We’re kind of in a position where we have a few years of pent-up demand. People have been sitting on the fence for a while. »

Ryalls said the new mortgage insurance rules are important, given the ability to find a home for less than $1 million in the Lower Mainland.

“It brings the product back to the territory for a lot of buyers,” he said. “This could potentially significantly change our market.”

Ryalls said the local market had already seen a significant jump in activity following the interest rate cuts in October.

He said real estate agents are expecting increased inventory and growing confidence heading into the new year, which will lead to an even bigger rise in sales.

“We’re expecting a pretty busy spring market,” he said.

“Buyers will be in a position where they will have to compete to purchase properties in the Lower Mainland again. »

© 2024 Global News, a division of Corus Entertainment Inc.