Micropile technology (Nasdaqgs: MCHP) saw a drop in price of 0.65% in last month, in the midst of a wave of developments. Recently, the company unveiled the family of PIC32A microcontrollers and a profitable circuit debugger, signaling a thrust to strengthen its position in the semiconductor industry. During the same period, the wider market was faced with challenges, the S&P 500 entering a correction phase drawn by economic uncertainties resulting from policy changes and tariff concerns. Despite a remarkable rally, the main clues ended on a lower note for the fourth consecutive week. Although individual technological stocks like Nvidia and Palantant have directed temporary recovery, market volatility has persisted. Unlike wider technology gains, reflected in the 3% increase in Vaneck Semiconductor ETF, the relatively minor decline in MCHP could be awarded to market conditions rather than developing specific to business. Meanwhile, the release of Robert A. Rango from the Board of Directors suggests potential changes in the context of governance.

Evaluate the prospects for microchip technology by accessing our report on profits growth.

Over the past five years, the total return on microchip technology shareholders, including the equity and dividends, increased 95.82%. This performance highlights significant growth and resilience in various market conditions. While microchip revenues increased by 21.8% per year during this period, recent developments such as the introduction of the Pic32A family of microcontrollers in March 2025 and the basic debugger during Basic highlight the company’s commitment to extend its semiconductor offers. The publication of these innovative products supports applications in the automotive, industrial and data centers, potentially improving long -term demand.

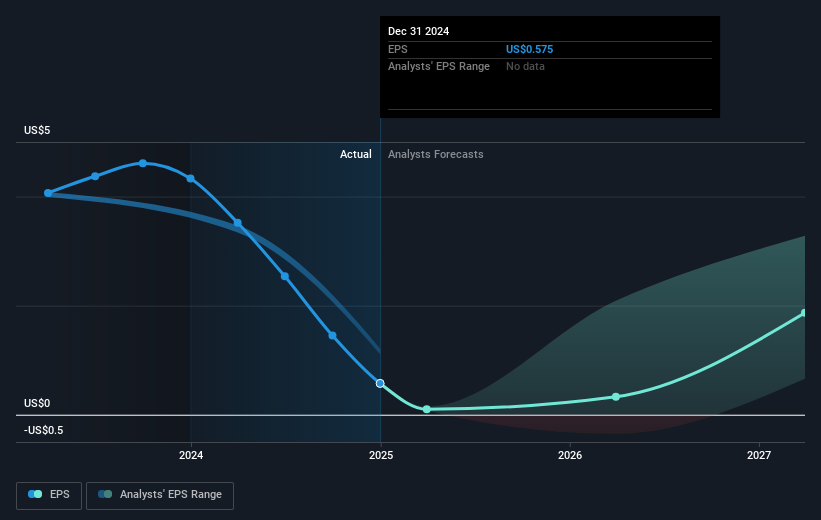

In the past year, however, microchip performance has lagged behind, underperforming both the American yield of the 16.5% semiconductor industry and the gain of 9.5% of the larger market. Despite these challenges, profits should increase at a significant rate of more than 42% per year in the years to come, growth in expected income greater than that of the American market. However, the company’s price / benefit / benefit ratio remains high, indicating that it can be perceived as expensive compared to the averages of the industry.

This article by simply Wall St is general. We provide comments based on historical data and analysts forecasts only using an impartial methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to purchase or sell stock and do not take into account your objectives or your financial situation. We aim to provide you with a long -term targeted analysis drawn by fundamental data. Note that our analysis may not take into account the latest ads of the company sensitive to prices or qualitative equipment. Simply Wall St has no position in the actions mentioned.

New: Manage all your stock wallets in one place

We created the Ultimate wallet companion For equity investors, And it’s free.

• Connect an unlimited number of wallets and see your total in a currency

• Be alerted to new warning or risks by e-mail or mobile

• Follow the fair value of your actions

Do you have comments on this article? Concerned about content? Get in touch With us directly. Alternatively, e-mail editorial-am@simplywallst.com