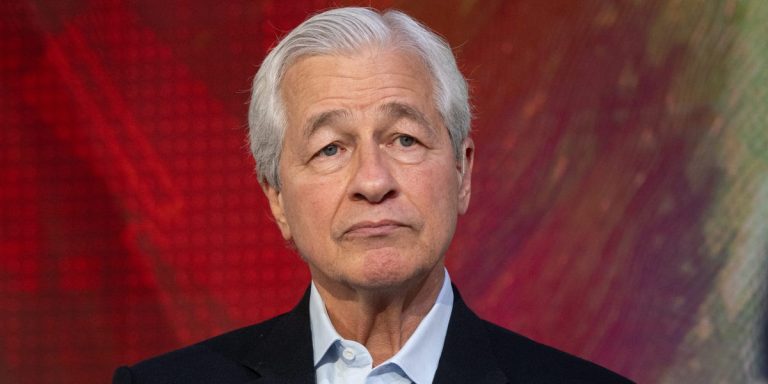

JPMorgan Chase CEO Jamie Dimon said the United States had to quickly come together on trade.

Dimon discussed the current tension between the United States and China on Friday at the Reagan 2025 National Economic Forum, where he led a conversation by the fire. When he was asked what his greatest concern was right now, Dimon underlined the changing global geopolitical and economic landscape, including trade.

“We have problems and we have to treat them,” said Dimon before referring to “the enemy inside”.

Tackling the “enemy inside,” he said, understands the setting of how the United States approaches approaches, regulations, taxation, immigration, education and the health system.

This also means maintaining important military alliances, he said.

“China is a potential opponent. They do a lot. They have a lot of problems,” said Dimon. “What really worries me is us. Can we bring together our own act? Our own values, our own capacities, our own management.”

Dimon said that if the United States is not “the military economy and pre-eminent pre-eminent in 40 years, we will not be the reserve currency. This is a fact”.

Although Dimon thinks that the United States is generally resilient, it said that things are different this time.

“We have to come together and we have to do it very quickly,” he said.

During the conversation, Dimon spoke of commercial transactions and encouraged American leaders to engage with China.

“I just returned from China last week,” said Dimon. “They are not afraid, friends. This notion that they will present themselves to America, I would not count on it.”

The Treasury Secretary, Scott Bessent, disagreed with Dimon during an appearance of Sunday on “Face The Nation” of CBS.

“Jamie is a big banker. I know him well, but I would not agree with this evaluation,” said Bessent. “May the laws of economy and severity apply to the Chinese economy and the Chinese system, like everyone else.”

Trump’s decision to impose prices On many countries, including steep prices on China, have traced the world markets earlier this year. The markets recovered after many countries, including China, began to negotiate. But the possibility that prices can increase at any time investors and economists on the edge.

Friday, for example, in a social position of truth, Trump accused China of violating the trade agreement of the two countries. The same day, Trump said that he planned to increase prices on steel imports from 25% to 50%.

“We are going to increase it from 25% to 50%, steel prices in the United States of America, which will still guarantee the steel industry in the United States. No one will go around,” Trump said at a rally near Pittsburgh.

The representatives of JPMorgan Chase refused to comment.