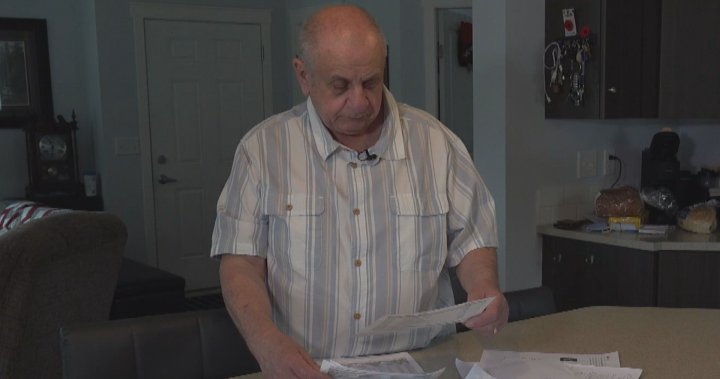

A man from British Columbia said for almost eight years with whom he fights Transunion Canada to prove that he is alive. “I cannot go and borrow money anywhere because Transunion brought me into it as deceased,” said Bryan Kupiak.

The Northern Okanagan resident says his problems with the credit report agency began at the end of 2017 when his mother died. Kupiak says that his social insurance number had been wrongly changed with his mother on his death certificate. “I didn’t know I was dead. As my pension stopped, there is something here,” Kupiak said.

Kupiak says he was able to eliminate confusion with the federal government about his pension, but when he went to borrow money, he encountered problems again. “I went to borrow money from the bank. I was buying a new house and I just needed a few to deposit a deposit and my own credit cooperative would not give me money, “said Kupiak.

It was then, said Kupiak, he discovered that Transunion Canada had wrongly declared him as deceased. He says it is a situation that he could not resolve by himself. Kupiak says that when he calls transunion to correct the error on his file, he said that there was no problem even if his transunion documentation proves the opposite. “After eight years, it’s ridiculous. I am 73 years old. It started when I was 65,” said Kupiak.

Kupiak says that Transunion had asked him to send copies of his passport and his driver’s license by mail for verification, but Kupiak says he is uncomfortable.

Get daily national news

Get the best news of the day, the titles of political, economic and current affairs, delivered in your reception box once a day.

“With all the scams that occur today, you do not want to send to anyone private information on yourself,” said Kupiak. “I did not know who I was talking to. All they would do was give me their first name. ”

At one point, Kupiak contacted the Better Business Office to get help, but the BBB has since ended its unresolved case.

Consumer issues contacted Transunion Canada on behalf of Kupiak and received an appeal immediately. Kupiak says that Transunion apologized and assured him that the problem was now solved.

“I was no longer dead,” said Kupiak.

In an email to consume Matters, Transunion Canada said in part:

“For reasons of confidentiality, we do not provide information on individual consumers.

The erroneous consumer death reports are rare, but they occurred on occasion. Transunion receives information from various sources and, in some cases, incorrect data may be reported to us.

When this happens, our contact center can launch a survey when receiving a request to correct the information. In certain situations, consumers may need to contact the original source of information directly to solve the problem. In other cases, transunion can correct the file once the identity of the affected individual has been verified… ”

The credit consulting company said that consumer errors on credit reports are not uncommon.

“When disinformation appears on your credit report, this will have a deep effect on your credit scoring.

“Of course, all the information on your credit report is calculated on the algorithm to give the scoring. When the information is wrong, it is important to act quickly and to try to correct it,” said Mark Kalinowski who is a specialist in Credit Counseling Society

In the meantime, Kupiak says it is satisfied that his information is finally corrected with transunion and can put a long and frustrating experience to rest.

& Copy 2025 Global News, A Division of Corus Entertainment Inc.