The Biden administration’s aggressive regulatory stance toward big businesses has hampered growth, a cohort of entrepreneurs, venture capitalists and other business industry experts told Fox News Digital.

Earlier this week, Albertsons abandoned its $25 million merger with another grocery store Kroger chain, after the Federal Trade Commission (FTC), led by President Biden appointee Lena Khan, sought to challenge the takeover, arguing it would stifle competition and raise prices. The challenge and eventual failure of the merger is the latest example of the Biden administration’s offensive against big business.

“We’ve literally had offers from strategic buyers to buy us, and we go to our lawyer and they say, ‘Don’t even try. The FTC will absolutely report this thing, and you’ll spend tens of millions dollars and will be stuck in bureaucratic hell answering questions from the courts for a year,” said Ravin Gandhi, a venture capitalist and former CEO who has been involved in multiple merger and acquisition deals and who maintains a stake in a certain number of startups.

“Lena Khan has been explicit in talking about M&A, even in the mid-market, as a vehicle for monopoly. And anyone who has built a business and sold it, like me, knows that’s ridiculous.”

The Federal Trade Commission headquarters in Washington, DC, is seen on November 18.

The chilling effect described by Gandhi has been echoed by other analysts, who say the Biden administration’s rhetoric and policies have forced companies to take matters into their own hands by abandoning or restructuring their deals in the face of antitrust concerns. of the FTC and the Department of Justice. A analysis International law firm Morgan Lewis found that under Biden, the vast majority — nearly three-quarters — of all transactions in which the government asked companies for more details about a proposed merger were subject to enforcement action.

“America wants a different choice,” said Grant Cardone, CEO of Cardone Capital. “This idea that Joe Biden is going to make the world more competitive is a false lead.”

Cardone also expressed frustration with regulatory battles with the Biden administration, noting that it has made it “nearly impossible for people to do business.”

Grant Cardone, CEO of Cardone Capital, attends Gateway Celebrity Fight Night 2024 in Scottsdale, Arizona on April 27.

Several other business leaders, venture capitalists and people with extensive knowledge of mergers and acquisitions echoed the concerns shared by Gandhi and Cardone that business growth was blocked.

“The FTC’s aggressive antitrust enforcement under the Biden administration has significantly dampened M&A activity, particularly in the technology sector,” said Kison Patel, fintech entrepreneur and host of “M&A Science.” , a podcast about mergers and acquisitions. “For example, a Fortune 10 technology company reduced its transactions from 30 to less than five.”

Armen Martin, a veteran mergers and acquisitions lawyer, added that in speaking with venture capitalists, he had heard optimism about FTC Commissioner Khan’s departure. She will be replaced by President-elect Trump’s nominee for FTC Commissioner, Andrew Ferguson.

“I think there will be a lot more M&A activity under the Trump administration because companies will be more confident that the government won’t get involved,” Martin said.

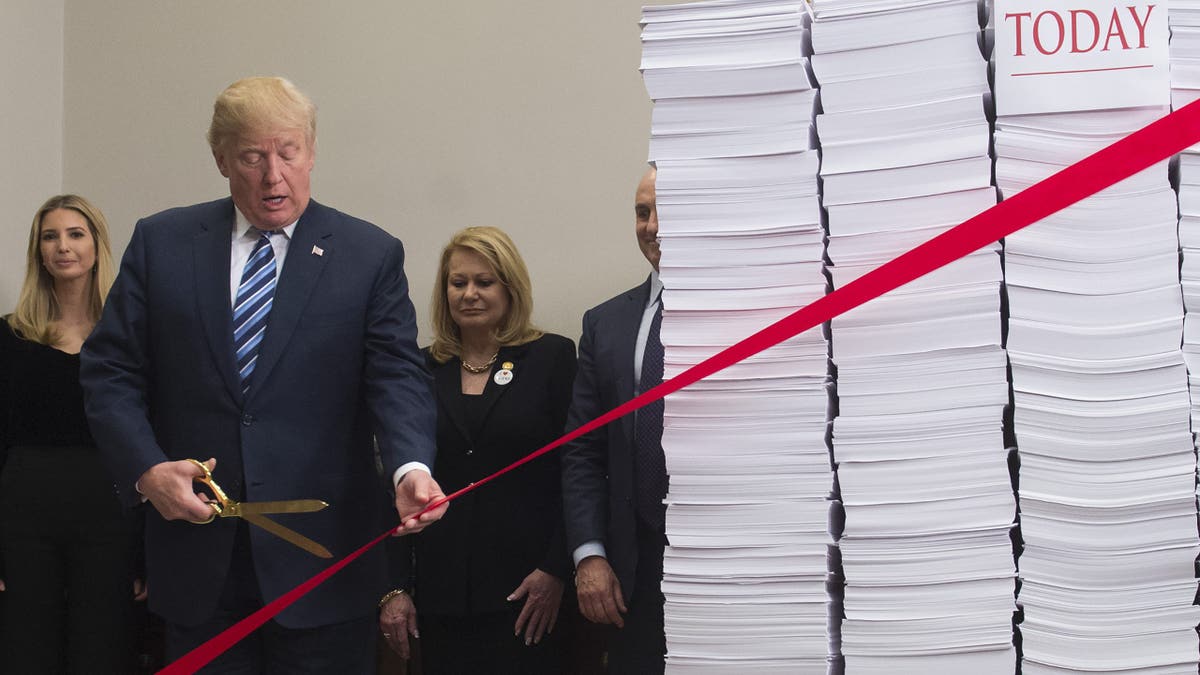

President Trump holds gold scissors as he cuts paperwork tied between two stacks of papers representing government regulations from the 1960s and regulations today in the Roosevelt Room of the White House in Washington, DC, on December 14, 2017.

CLICK HERE TO GET THE FOX NEWS APP

Meanwhile, in a statement to Fox News Digital, FTC spokesperson Douglas Farrar said the recently blocked grocery store merger “clearly shows that strong, reality-based antitrust enforcement gets real results for consumers, workers and small businesses.

“Today’s victory protects competition in the grocery market, which will prevent prices from rising even further,” he added.