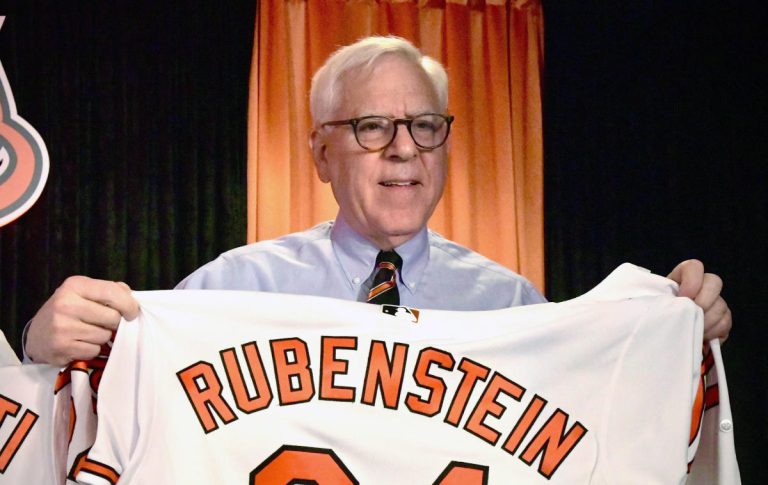

Billionaire owner of the Baltimore Orioles, Carlyle Group (CG) co-founder David Rubenstein pushes the yes button on a salary cap for Major League Baseball.

“I wish we had a salary cap in baseball like other sports do, and maybe one day we will, but we don’t have it now,” Rubenstein told Yahoo Finance during of the press conference. World Economic Forum in Davos, Switzerland. “I suspect we will probably have something closer to what the NFL and NBA offer, but there are no guarantees on that.”

The lavishly spending Los Angeles Dodgers imposed the luxury tax this offseason, with an estimated payroll of more than $370 million. That would exceed the payroll of the other big spenders in the New York Yankees and Philadelphia Phillies.

The Baltimore Orioles’ payroll is in the middle of the pack in the MLB at over $150 million for 2025, screened by Fangraphs. Rubenstein – who purchased the team as part of a consortium for $1.725 billion – says he will increase the team’s payroll and renovate its Camden Yards baseball stadium. However, he believes a broader discussion needs to take place to narrow the gap between large and small market teams.

“I think the big city teams have some advantages. Now, in Los Angeles, they have another advantage. They have Japanese players, (a) number of them, like Shohei (Ohtani), and the Japanese really enjoy watching Dodgers games, and they sell a lot of merchandise in Japan for Dodgers players,” Rubenstein said.

Economically, Rubenstein is optimistic about the prospects under President Trump.

“I think the business community is generally optimistic about what the Trump administration is likely to do. That’s not to say that the Biden administration hasn’t done some things that have been very good for business, “But it’s clear that this administration is seen by the business community as much more sympathetic, rightly or wrongly,” Rubenstein said.

Excitement over Trump’s potential policies has some on the Street worried the stocks are overvalued. The unknowns include the final outcome of Trump’s tariff threats and the outlook for Fed policy.

Stocks are ‘priced to perfection,’ warns Goldman Sachs strategist Peter Oppenheimer this month.

Oppenheimer said the short-term outlook for stocks is complicated.

“First, the speed of recent stock price gains has reflected much of the good growth news we expect. Second, high valuations are likely to limit forward returns. Third, unusually high market concentration increases Portfolio risks: Concentration increased by geography (the United States is increasingly dominant), by sector (technology generated the bulk of stock returns) and by stock (the five largest stocks in the United States). -United States represent about a quarter of index),” Oppenheimer explained.