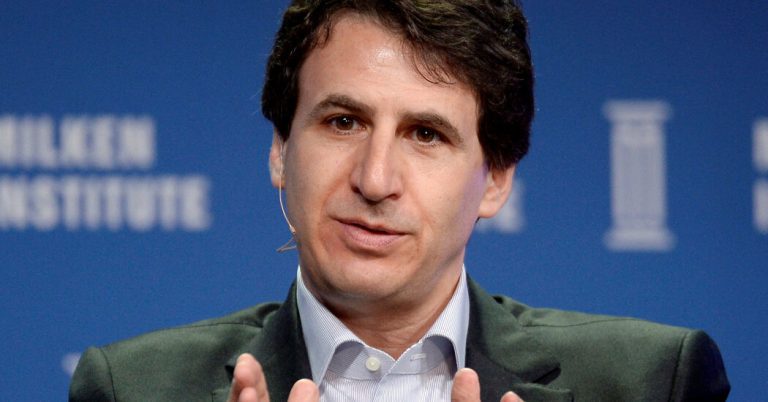

I spoke to Marc Rowan, CEO of Apollo Global Management, about a provocative plan which, according to him, could fundamentally reshape our economy and finally repair the federal budget. That it has a chance to be implemented is an open question, but Rowan’s ties with President Trump and the chatter that the plan generates means that it could take into account budget talks later this year.

Several weeks after President Trump won the elections, he invited Marc Rowan, the co-founder and chief executive officer of Apollo Group, the giant investment and credit company in Mar-A-Lago for A job interview to become the secretary of the Treasury. Rowan, who was in Asia for meeting investors at the time, canceled all his plans and stolen worldwide to meet Trump. Rowan, who is undoubtedly one of the most powerful financiers in the world, spoke with Trump but ultimately did not get the post. (Scott Bessent did it.)

But since then, he has become an increasingly influential voice on economic policy in the orbit of President Trump and even among some Democrats – And he presented a very specific plan.

Rowan, CEO of Apollo, is the champion of a budgetary model for the federal government which he helped to finance at the Wharton school of the University of Pennsylvania, where he is Chairman of the School Council Council. Called the “Penn Wharton budgetary model,“This involves reducing taxes, but also reducing almost all tax exemptions; increase the tax rate of capital gains; Creation of a carbon tax and rewriting immigration and health care rules. Its suggestions – which, according to the model, could, by 2054, create a 38% reduction in federal debt, a 21% increase in GDP and a 7% increase in wages – are likely to draw hooks and Applause of Republicans and Democrats.

You will probably hear much more about the idea with the crucial budgetary discussions this summer. With the amount of the federal debt to a record level which concern of republican and progressive economistsNo sudden drop in interest rates in viewAnd the president began to extend the tax reductions which would increase the deficit to 3.7 billions of dollars over the next 10 years, according to the Congressional Budget Office, political decision -makers buy unconventional solutions.

I sat with Rowan recently to discuss the plan and how it happened. The interview was published and condensed.

What inspired you to start looking at these problems this way?

In 2008, I saw the Obama administration rewrite the whole American economy – restructuring airlines, cars, finances, insurance. And they were hostile to industry. I won the phone and called the president of the University of Pennsylvania, Amy Gutmann. I told him that I build for you an entity focused on research, focused on the budget, if you support it. And it was the genesis of Penn Wharton’s budgetary model.

Why were you interested in creating the model?

There is no budgetary model for the country. It’s like 28 Excel calculation sheets. And if you bring coffee and donuts in the morning, you get a better score than if you haven’t done. If you are chairman of the committee or you are a senator and want to negotiate a bill, you can only mark your bill after. Imagine that you take a takeover, but you cannot run the figures before you agree to buy it! This is how our government works.

Given the current budgetary situation – the United States should register a $ 1.9 billion budget deficit This exercise – how over our economic challenges are surmountable?

There is no configuration of tax reductions and discounts of expenditure and modifications of the current package and salt which will result in something significant because we have waited too long. But that does not mean that it is not possible.

So what exactly would you do?

Well, what did Trump promise? He has promised low tax rates. I can get him low tax rates, 28%. He promised a lower business rate. I can get him a business rate of 15%. He promised to balance the budget and budgetary prudence without making a lot of things that provide rights. I can do it too. This budget gives it an alternative. There is not a single cut in this budget. If they get cuts and Doge work and do many other things, it’s all backwards.

It’s remarkable if it’s true. Let’s move on to details. You are talking about reducing the highest tax rate and getting rid of deductions at a time when many people believe that the richest pay too little.

A low marginal rate allows you to remove a lot of distortions. To the point, the higher marginal tax rate becomes 27% (against 37%), the deduction for salt is not worth as much. The capital is differential, it simply is not worth as much. Tax planning and confidence and gadgets around inheritance planning are simply not worth as much. And so what you start to do is devalued this whole game and you even start to devalue the whole concept of differences between s-body and companies and other things. And the simplification of not focusing on deductions is extremely positive. The people that I generally managed by who pay capital gains and that do these things are like: “Okay, register me.”

You are also talking about reducing the company’s rate to 15%.

We have a corporate rate of 21%. But the effective rate is 13.6. We therefore collect taxes according to something close to 15, but we incite companies to make decisions on 21. All of a sudden, everyone would make the marginal decision at 15 and we would not lose more or Less money. We change behavior.

What allows you from 21 to 13.6 is a series of distortions – the Christmas tree for ornaments: pharmaceutical radiation, R&D credits, all the distortions that obtain the rate of 21 to 13.6. Once you are 15 years old, why would you go to Ireland or in Bermuda? At this stage, all the incentives to move income in the world through this shell game also disappear.

Do you actually maintain that a tax rate of 15% is actually even higher than the average today?

Yes. You reward growth on the sidelines. You reward people who work more because the next dollar, they will keep more. This is what you want. It is an incentive. And you reward companies to record more of their income in the United States, because the marginal rate will be imposed at 15 instead of 21.

The progressive side would say that taxes should be even more progressive than they are. People at the end of the diapers as you are an even higher end than they have ever been. And so, they would say that we should think about how to impose this cohort in a different way given the bifurcation of income today.

Listen, it was tried all over the world. It didn’t work. Everyone who tried it essentially abandoned it. New York digs its tax plate. California is dug at its tax plate. This simply does not work because fundamentally, the richest in the world are the most flexible in terms of what they are ready to do to move. We are, as you know, the most progressive Western country with regard to the tax code. The percentage of tax paid by the rich for this proposal and for people like me, my taxes increase the first day.

Will you pay more under this?

I pay more under this than I do it differently.

You get rid of the “base of step in place at death”, a provision that erases capital gains in the portfolio of a deceased person and values everything on the date of death, which most Republicans would not like.

I like that we allow a generation of entrepreneurs to build wealth and keep their wealth and keep more. But when they die, they cannot transmit it to a tax franchise. It seems incredibly American to me.

I think that if you develop your wealth and you always work, you will like this plan because even if you will pay more today, everything you do in the future, you will keep more until your death.

But doesn’t everyone do it?

On the other hand, if you are rich, you will not like this plan because you will pay more today on capital gains. I don’t think it’s a bad result.

The model includes this idea of obliging illegal immigrants to pay for health insurance. How would it work and what is the impact?

We will end up with a massive part of the population discovered by health insurance due to the cost. With this plan, we end up with almost universal health coverage.

How so?

The premiums descend because you add this massive requirement so that young immigrants are in the health care basin, which lowers premiums by almost a third.

So you are not to expel all illegal immigrants?

What I’m talking about are smart deportations. Get rid of the people you need to get rid of you, as they are a risk for society. Recognize that you have a lot of people here who are here for economic reasons, who perform valid functions, but do not let them roll free on the economy.

But will the cost of insurance not be simply transmitted to the employer and therefore to the consumer?

For the industries that have benefited from illegal immigration, this will impose costs on these industries, because there will be a certain fractionation of the additional costs between the immigrant and the businesses.

What kind of reaction have you succeeded in all of this?

I didn’t expect that. The interest I receive is outside the graphics, and it is not Republicans or Democrats, because depending on the glasses you use, this could be a really republican bill – lower marginal tax rates, you Know, corporate tax rates, right? Or it could be a truly democratic bill, which is not a tax relief of capital gains, no advantage in death, right? Health insurance requirement. It allows people to look at this with their own opinion on what it is.

Honestly, how realistic this is all of this?

Washington, left to itself, will be absolutely nothing other than the status quo. They will break and jive and budget gimmick and they will not reach anything. And the deficit will continue to go up. It is only if they obtain a certain market charge or if it becomes politically unrealizable to pass a budget of status quo which they will consider as an alternative.

Thank you for reading! We will see you on Monday.

We would like your comments. Please send an email to thoughts and suggestions to Dealbook@nytimes.com.