-

Revenues: 333.8 million US dollars (up 26% compared to financial year 2023).

-

Net loss: US 40.8 million dollars (35% narrowed compared to financial year 2023).

-

Loss of US $ 0.41 per share (improved compared to a loss of 0.67 USD during financial year 2023).

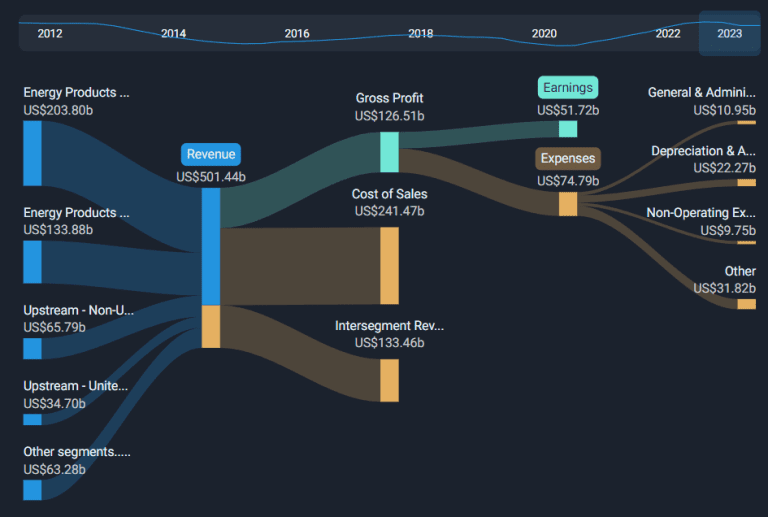

All figures represented in the above graph are for the 12-month train period (TTM)

Revenues were in accordance with analysts’ estimates. Action profit (BPA) has exceeded the estimates of analysts by 1.8%.

For the future, revenues should increase by 21% of AP on average over the next 3 years, compared to a growth forecast of 12% for the software industry in the United States.

Performance of American software industry.

The company’s share price is largely unchanged from a week.

You must always think of the risks. Example, we spotted 1 warning panel for Alkami technology You must be aware of it.

Do you have comments on this article? Concerned about content? Get in touch With us directly. Alternatively, send an e-mail to the editorial (AT) simply.

This article by simply Wall St is general. We provide comments based on historical data and analysts forecasts only using an impartial methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to purchase or sell stock and do not take into account your objectives or your financial situation. We aim to provide you with a long -term targeted analysis drawn by fundamental data. Note that our analysis may not take into account the latest ads of the company sensitive to prices or qualitative equipment. Simply Wall St has no position in the actions mentioned.