Advice for owners on the deposit and payment of taxes, borrowing, managing workers and benefits and much more.

NEW and threatened prices. Fiscal expiration. Strict loan rules at Small Business Administration (SBA). The owners of small businesses face many challenges and uncertainty these days.

But then, starting and managing a small business has always been difficult. And yet, small businesses remain the pillar of the American economy, creating jobs, millionaires and, in some cases, large companies and billionaires. Diane Hendricks, n ° 1 Forbes’ New list of The richest self -taught women in Americawith a net value of $ 22.5 billionLaunched a roofing supply company with her late husband, Ken, in Wisconsin in 1982. Under her watch, ABC Supply, which she has owned and presided over the death of Ken in 2007, has become more than 900 branches and $ 20 billion in sales. Peter Cancro began to make sandwiches in a sandwich at the Jersey coast in 1971 at the age of 14, bought the owner before his graduationAnd built Jersey Mike in a chain with more than 3,000 locations, before finally selling a majority participation this year in the Blackstone capital-investment company. He is is now worth $ 4.9 billion.

Today, the United States has more than 33 million small businesses, employing nearly 62 million Americans, or 46% of private sector employees. According to the SBA, from 1995 to 2021, small businesses created 17.3 million new net jobs, representing 63% of net jobs created during this period. However, this impressive number of net employment growth is millions of births and small businesses. About one in all small in five companies fail during their first year and one in two succumbs in the first five years.

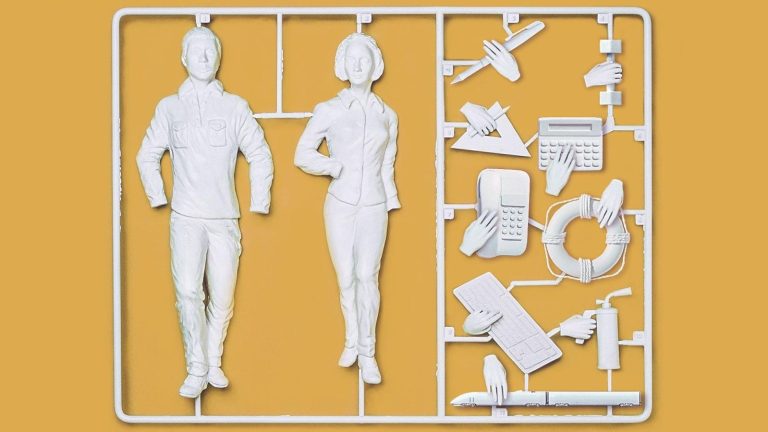

This new Small Business Forbes toolbox aims to help you beat the chances, with information on the choice of the right entity, the reference of your professional team, the deposit and payment of taxes, management of small businesses, etc. Despite the drama in Washington, some of these commercial bases will not change. But some will change – we therefore intend to keep the toolbox up to date, owners of development companies are probably too busy to follow alone.

Small businesses have been faced with more important challenges than normal in recent months when they have trouble navigating the prices and tax proposals of President Trump. The threat of prices (and rates already imposed) has already led to higher expenses and disturbances of the supply chain for certain small businesses. And others are probably coming. Since the prices are paid by American companies that import goods and materials, many small businesses will have to pay more for what they buy, but could not transmit complete cost increases to customers. The most recent independent optimism index of the National Federation of Small Commercial Enterprises shows in particular retailers, in particular, had their enthusiasm held back by prices.

The Republican tax bill, adopted last month by the House, included Some victories for small businesses. He restored the expenses and carried out the existing deduction of article 199a for small businesses which transmit their profits to the permanent and more generous independent partnerships and workers). But those who hope that a Senate adapted to companies could also push by also reducing the tax rates of companies, will probably not have their wish. The cost of the invoice (and how it increases the federal deficit and the debt) can mean that we will see less, no more, tax relief for businesses, because it makes its way through the Senate and the process of reconciliation.

Adding to uncertainty, interest rates and other costs remain high, which makes the loan delicate at a time when the assistance of federal agencies like the SBA has been reduced (the agency announced its intention to reduce its workforce by 43%) And Tight loan warranty. Staff reduction at IRS (the agency provides lose at least 20,000 employees) means that there are fewer representatives available to respond to phones and help resolve tax disputes – some of these tax problems, such as privileges, can paralyze a small business, if not resolved in time.

There are light points. Earlier this year, the Treasury Department redirected Most of the business transparency law (CTA), limiting its scope to foreign companies. Before the revision, around 32.6 million companies were potentially subject to declaration requirements, with significant sanctions for non-compliance. The administration has also indicated that more regulatory decline is coming, although companies are not yet sure what it might look like.

With so much uncertainty – and more changes along the way – we suggest putting this toolbox as a bookmark and checking our updates.