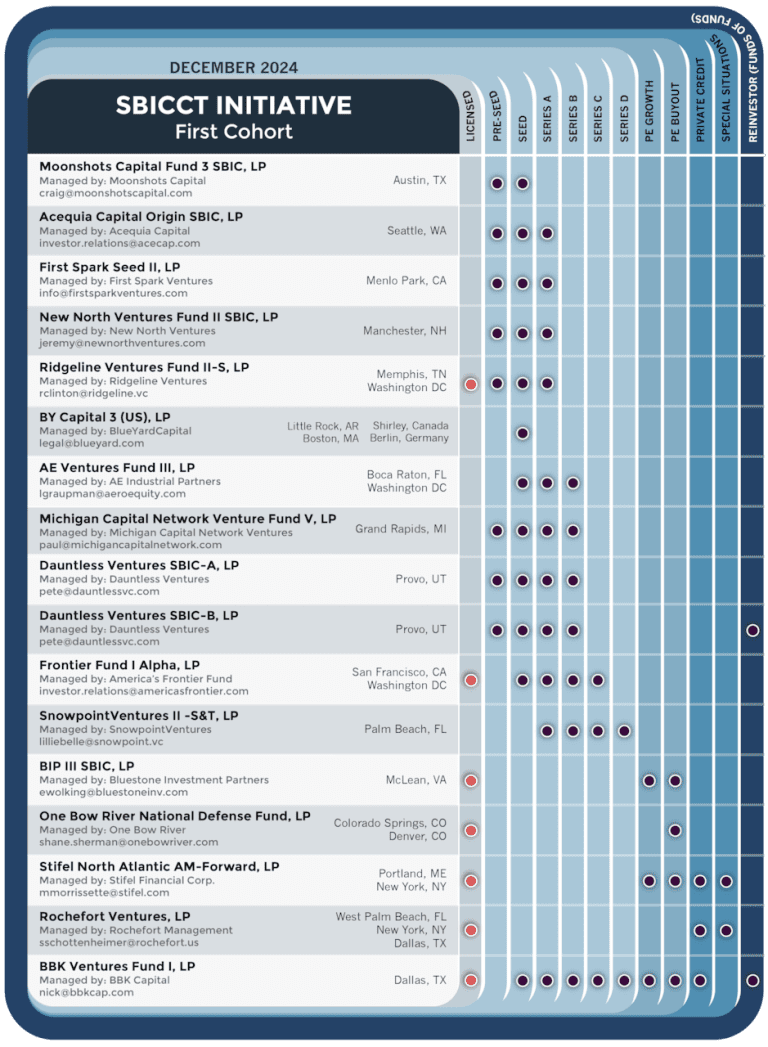

Today, the Department of Defense (DoD) is releasing the names of the entire first cohort of funds licensed and green-lighted under the Small Business Investment Company Critical Technologies Initiative (SBICCT Initiative). The SBICCT Initiative is a partnership between the DoD and the U.S. Small Business Administration (SBA) aimed at strengthening U.S. national and economic security by attracting and increasing private investment in the DoD Critical Technology Areas (CTA) and in technologies and production processes at the component level.

Collectively, this first cohort is expected to invest more than $4 billion in more than 1,700 portfolio companies focused on the 14 CTAs and strategic component technologies and production processes. These investment funds come from all regions of the country and have offices in 15 states and Washington, DC. Together, this first cohort plans to invest across the full range of private investment stages and strategies, including seed, venture, growth, buyout and direct lending. , special situations and funds of funds.

To meet the direction of the Green Light Letter, these investment funds:

● Prepared and submitted a detailed application describing, among other things, their management team, investment strategy, track record, fund structure and copies of their governing documents.

● Successfully complete a rigorous operational and investment due diligence process and legal review of their application.

● Participation in a formal interview with the SBA Investment Committee.

● Received notification that the fund had demonstrated the experience and skills required to successfully operate a small business investment company (SBIC) from the Investment Committee, the SBA Agency Licensing Committee and from the SBA Administrator.

After receiving the “Green Light Letter”, each fund is invited to raise private capital. When the fund is ready to close the initial round of private capital, that fund will apply to receive its SBIC license – after which it will be able to access its approved leverage and begin investing in the portfolio companies. Seven funds from the first cohort are fully authorized and have started investment activities.

**The chart above lists 17 of the 18 funds licensed and green-lighted in the first cohort of SBICCT Initiative funds. One fund that received the green light chose not to share its name publicly, which is allowed by SBA policy.

Interest in the SBICCT Initiative continues to grow, with over 100 funds expressing interest to date. The diligence process has begun for the second cohort of funds that applied to the SBICCT Initiative, and additional funds are expected to file applications by the next filing deadline of March 31, 2025.

For more information about the SBICCT Initiative and the application process, please see the Investment Policy Statement. here or contact capitalmarkets@osc.mil to arrange a courtesy visit.