The good performance of the technology sector continued in the fourth quarter and we consider it to be quite valued overall. The software companies’ continued strong results ultimately led to a strong recovery in the group between early September and early December, leaving the group slightly overvalued, in our view. Overall, technology was one of the best performing sectors in the fourth quarter, and the second best performing sector over the last 12 months. We see no consistent differentiation in performance across market capitalization brackets. We remain confident in favorable long-term technology trends, such as cloud computing, artificial intelligence and the long-term expansion of semiconductor demand. However, after a strong end to 2024, we see limited near-term opportunities for the sector.

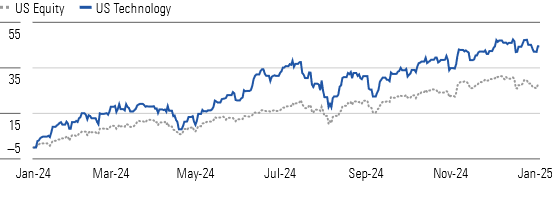

THE Morningstar US Technology Index is up 36% on a rolling 12-month basis, while the US stock market is up 24%. Over the past quarter, the U.S. stock market rose 3%, while the technology market rose 6%.

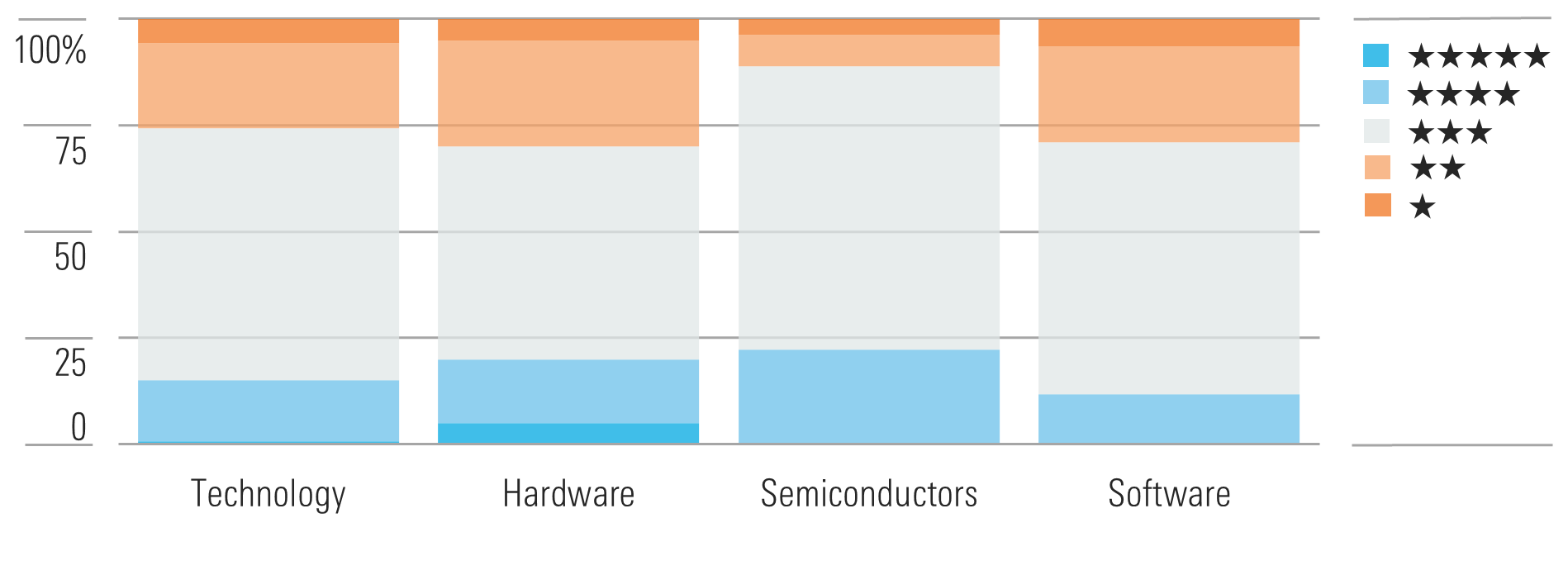

The median US technology stock is fairly valued, with a modest margin of safety. We view software and hardware as the most overvalued, with semi-active the most attractive, as shown in the lower right panel.

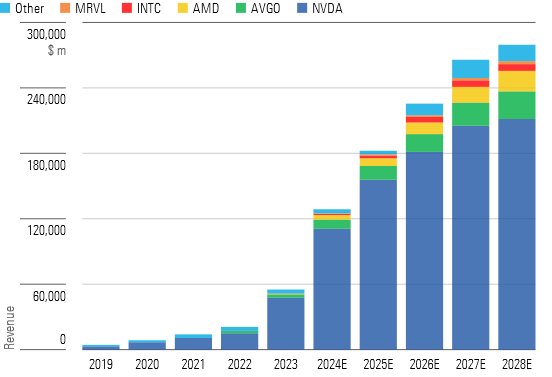

Generative AI remains the most important theme in the industry. Software companies are developing and integrating next-generation AI capabilities into their solutions, while cloud providers are introducing new services and increasing their capabilities. Some semiconductor companies, including Nvidia NVDAare experiencing growing demand for AI applications and data center chips. That said, Nvidia shares surged earlier in 2024 but have stabilized recently despite continued strong demand.

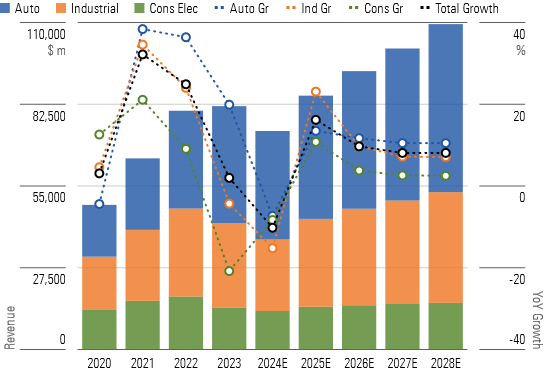

We expect AI accelerator revenues to grow approximately 4x over the next few years, making AI the primary growth driver for the semiconductor industry. We expect Nvidia to lead this initiative, but other companies should benefit as well. Meanwhile, demand for analog chips suffered in 2023 and 2024, with automotive and industrial seeing a slowdown, along with most other end markets. We believe in long-term structural growth tailwinds for analog, including increasing semi-trailer content per vehicle, industrial automation, 5G deployment and other themes.

Top Tech Sector Picks

NXP Semiconductors

NXP NXPI is one of our top picks in the area of analog and mixed-signal chips. We particularly like the company’s outsized exposure to the automotive end market, where it generates nearly 50% of its revenue. NXP is well diversified in the automotive sector, with a nice product range of processors, microcontrollers and analog parts. We believe the company will also earn its fair share in automotive electrification and safety products, such as radar and battery management systems. Overall, NXP’s automotive business is well tied to secular tailwinds around increasing chip content per vehicle, and we believe the market is too focused on a near-term slowdown in demand. We expect NXP to return to revenue growth in 2025.

STMicroelectronics

STMicroelectronics STM is one of our top picks in the sector, as we believe our fair value estimate provides an attractive margin of safety for patient, long-term investors. We continue to appreciate long-term tailwinds in the automotive end market, as STMicroelectronics stands to benefit from increasing chip counts per car, particularly in electric vehicles. The company has also achieved nice gross margin growth in recent years, and we expect it to maintain these margins over the long term.

Microsoft

Microsoft MSFT dominates many of its served markets, such as with Office for productivity software and Windows for PC operating systems. The company has also established itself as one of the two undisputed leaders in the public cloud. We believe the proliferation of hybrid cloud environments will continue to strengthen Microsoft’s position with Azure. Additionally, the company’s investment in OpenAI has propelled Microsoft into a leadership position in the generative AI space, which has driven Azure’s growth in recent quarters. Our growth assumptions are focused on Azure, Microsoft 365 E5 migration, traction with Power Platform for long-term value creation and AI proliferation.