Today’s resiclub letter is brought to you by Cates!

Follow each dollar with Stessa – without effect

The management of finance of rental properties should not be a headache. With Stessa, real estate investors can simplify accounting, automate transactions monitoring and stay organized, all on a powerful and easy to use platform. Connect your bank accounts, real estate managers and financial institutions for a clear and precise financial image throughout your portfolio.

Stessa also renders stress -free accounts. Follow income and expenses by property or wallet, scan and recover receipts on the go and ensure that each transaction is classified to maximize your deductions. Whether you manage a portfolio locally or extend across the country, Stessa keep you in control of almost anywhere.

📹 Look at the demo And see how Stessa can rationalize your rental property finances.

The housing market is transformed by lifestyle delays

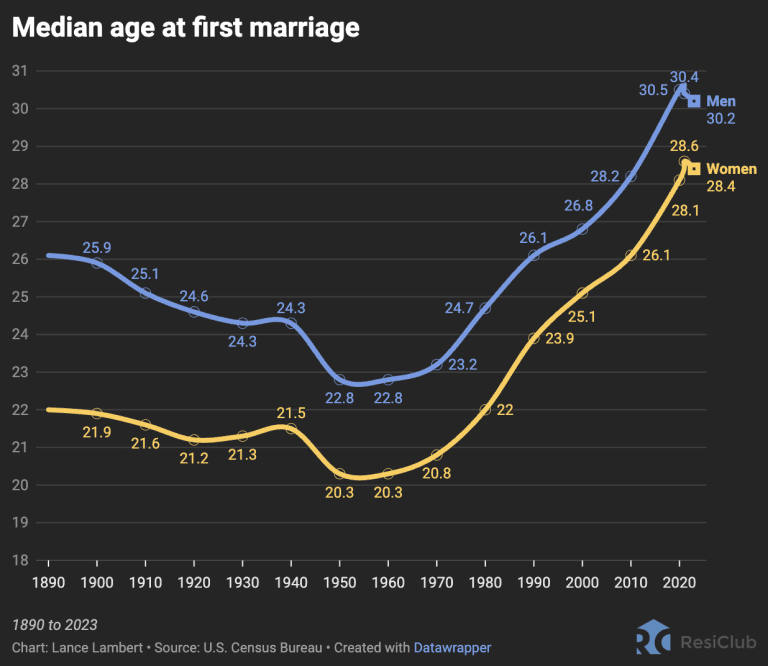

One of the greatest underlying forces reshaping the US housing market is the phenomenon of lifestyle. The young generations postpone the traditional stages of life in adulthood: stay at school longer, get married later and have children later – and often fewer children overall.

This secular trend, of course, did not start yesterday.

Indeed, this change towards transitions later in life has been occurring for decades – and has occurred in the developed world.

This cultural change has implications for housing.

Delaying marriage and parenting often means delaying the first home purchase. Historically, getting married or starting a family has been the main trigger to buy a house. But with the median age of new buyers of houses being 38 years old in 2024 – up to 28 years in 1991 – this trigger occurred later.

Of course, part of the recent jump of the median age of house buyers for the first time can be attributed to the accessible deterioration of the affordability of housing in 2022, but the lifestyle changes also play a role.

At the same time, when Americans form households, these households tend to be smaller than in the past. Birth rates have regularly decreased and more adults live alone or less dependent. Indeed, the share of households of a person and 2 people increases, while households of 3 people, 4 people, 5 people, 6 people and 7 people continue.

What stages can housing be used to benefit from this secular change?

-

From the company’s point of view, do not fight the trend – the TODAY housing market will not suddenly return to the 1970s or 1990s, when a large number of 20 years enter the property. Demographic and lifestyle changes mean that young buyers enter the market later, and that reality is there to stay (even if the median age of buyers for the first time of 38 years in 2024 takes place a little).

-

Agents, manufacturers and investors should pay particular attention to the preferences of 30 years and increasingly rich. This group now represents an important part of the first activity of purchasing a house, and above all, many of them are ready to become repeated buyers in the coming years. Understanding their needs today can establish relationships with long -term customers tomorrow.

-

There is a rental opportunity to serve the end of the twenties and the 30th anniversary which, during past generations, would have already entered the property but which now spends more years in the rental phase. This is the basic thesis that stimulates many builders of Build-to-Lent with which I speak. These communities offer a transition life for buyers of new delayed buyers, looking for space, privacy and the sensation of a unifamilial house, without the long -term commitment or the initial costs of the property.

Are you a real estate investor? Do you have a rental property? 🏠

If this is the case, you are invited to participate in Cates-Speicub Real Estate Investor Survey.

The results of the survey will be published shortly after in Resiclub and other major media publications.

So far this month, here are additional research articles on housing that Resiclub Pro members (Paid tier) received: