In the past three months, 6 analysts have shared their evaluations of the life accessories of actions (NYSE:ELS), revealing various perspectives as a lowering up.

Summarizing their recent evaluations, the table below illustrates the evolution of feelings in the last 30 days and compares them in the previous months.

| Bullish | A bit optimistic | Indifferent | Slightly lower | Drop | |

|---|---|---|---|---|---|

| Total notes | 1 | 3 | 2 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| There are 1m | 1 | 1 | 0 | 0 | 0 |

| There are 2m | 0 | 0 | 0 | 0 | 0 |

| There are 3m | 0 | 1 | 2 | 0 | 0 |

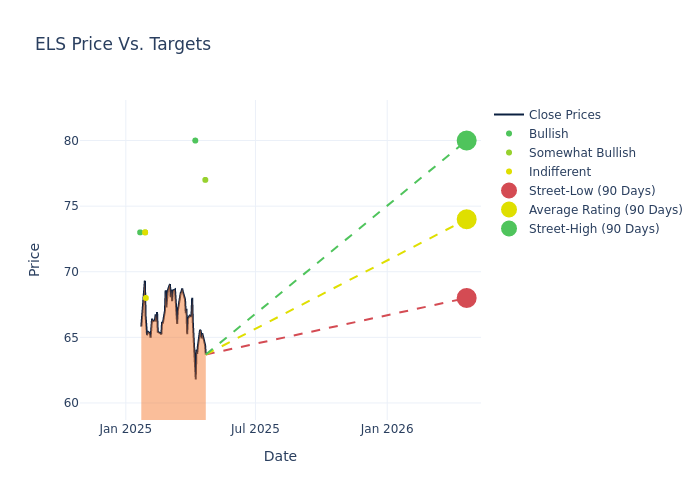

In the assessment of price targets at 12 months, analysts unveil information on stock accessories, with an average target of $ 74.83, a high estimate of $ 80.00 and a low estimate of $ 68.00. By observing an increase of 2.16%, the current average increased compared to the previous average price target of $ 73.25.

Investigate the notes of analysts: an elaborate study

A clear image of the perception of lifestyle accessories of actions among financial experts is painted with an in -depth analysis of the actions of recent analysts. The summary below describes key analysts, their recent assessments and adjustments to ratings and price objectives.

| Analyst | Analyst company | Action taken | Evaluation | Current price objective | Prior price objective | | —————— | —————— | ————– | ————– | —————— | ————– | | Juan Sanabria | BMO Capital | Lowers | Outperforming | $ 77.00 | $ 78.00 | | Peter Abramowitz | Jefferies | Announcement | Buy | $ 80.00 | – | | Juan Sanabria | BMO Capital | Ads | Outperformance | $ 78.00 | – | | Brad Heffern | RBC Capital | Lowers | Sector Perform | $ 68.00 | $ 69.00 | | Wesley Golladay | Baird | Return | Outperforming | $ 73.00 | $ 72.00 | | Steve Sakwa | Group Evercore ISI | Lowers | Online | $ 73.00 | $ 74.00 |

Key information:

- Action taken: Analysts adapt their recommendations to the evolution of market conditions and the performance of the company. Whether they “maintain”, “increase” or “drop” their position, this reflects their response to recent developments linked to the life accessories of actions. This information provides an instantaneous in which analysts perceive the current state of the company.

- Notation: Analyzing trends, analysts offer qualitative assessments, ranging from “outperformance” to “underperformity”. These ratings transmit expectations for the relative performance of the life accessories of actions compared to the wider market.

- Price targets: Including forecasts, analysts offer estimates of the future value of the Equity lifestyle accessory. Examination of current and previous objectives gives an overview of the changing expectations of analysts.

Taking these analyst evaluations into account in collaboration with other financial indicators can offer a complete understanding of the position of the actions of lifestyle accessories. Stay informed and make informed decisions with our table of grades.

Stay up to date on the analyst ratings of Equity lifestyle accessories.

Get to know the lifestyle accessories of actions

Equity Lifestyle Properties is a residential FPI which focuses on possession of manufactured housing, residential vehicle communities and marinas. The company currently has a portfolio of 452 properties in the United States with a higher concentration in the Sunbear region with 38% of the business of the company located in Florida, 12% in Arizona and 8% in California. The lifestyle of actions targets properties with properties in attractive retirement destinations with more than 70% of the business of the company, an age limit, an average age resident over 55 years of age.

Economic impact of the accessory on the way of life of actions: an analysis

Market capitalization analysis: The market capitalization of the company exceeds the averages of the industry, having a dominant size compared to peers and suggesting a solid market position.

Positive income trend: Examination of finances on lifestyle accessories of actions on 3M reveals a positive story. The company has reached a remarkable income growth rate of 0.36% As of December 31, 2024, with a substantial increase in high -level gains. Compared to its industry peers, the company follows a growth rate lower than the average among peers in the real estate sector.

Net margin: The net margin of society is an outside competition, beyond the averages of industry. With an impressive margin of 28.1%, The company has high profitability and effective cost control.

Back to equity (ROE): Egg eggs in the lifestyle of actions excellent beyond 6.06%. This means robust financial management and effective use of shareholders’ equity.

Return of assets (ROA): The ROA of Equity Lifestyle Props goes beyond industry standards, highlighting the exceptional financial performance of the company. With an impressive 1.7% ROA, the company actually uses its assets for optimal yields.

Debt management: The debt / investment capital ratio of accessories on the lifestyle of actions is significantly higher than the average of the industry. With a report of 1.84The company is based more on borrowed funds, indicating a higher financial risk level.

Analyst notes: simplified

The notations of analysts serve as essential indicators of the performance of the shares, provided by experts in bank and financial systems. These specialists analyze with diligence the financial statements of the company, participate in telephone conferences and engage with initiates to generate quarterly notations for individual actions.

Beyond their standard assessments, some analysts provide predictions for measures such as growth, profits and income estimates, providing investors with additional advice. Users of analysts’ notes must be aware that this specialized advice is shaped by human perspectives and can be subject to variability.

Breaking: Wall Street’s Next Big Mover

Benzinga’s n ° 1 analyst has just identified a ready -made stock for explosive growth. This company under the radar could increase by 200% + as major market changes take place. Click here for urgent details.

This article was generated by the Benzinga automated content engine and examined by an editor.

Latest notes for ELS

| Date | Farm | Action | From | HAS |

|---|---|---|---|---|

| April 2025 | BMO Capital | Keeping | Outfit | Outfit |

| April 2025 | Jefferies | Initiate a blanket on | Buy | |

| April 2025 | BMO Capital | Upgrades | Market market | Outfit |

© 2025 Benzinga.com. Benzinga does not providePlacement advice All rights reserved.

The opinions and opinions expressed here are the opinions and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.