Human Technology Co., Ltd (Kosdaq: 175140) Shareholders will not be delighted to see that the share price has experienced a very difficult month, lowering 25% and canceling the positive performance of the previous period. The longer -term shareholders would now have been a real blow with the title down 3.1% in the past year.

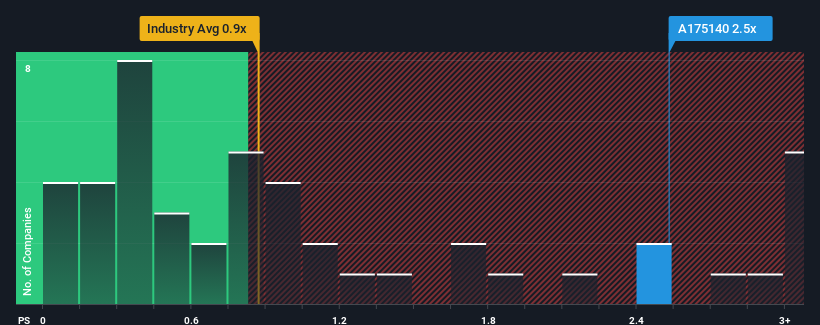

Although its price has dropped considerably, given that almost half of the companies operating in the Korean communications industry have price / sales (or “p / s”) ratios less than 0.9x, you can always consider human technology as a stock to potentially avoid its 2.5x P / S ratio. Nevertheless, we would need to dig a little more to determine if there is a rational basis.

See our latest analysis for human technology

What does human technology mean for shareholders?

Income has recently increased for human technology, which is pleasant to see. Perhaps the market expects this decent income of the short-term industry, which has maintained the supported P / S. However, if this is not the case, investors could get caught up too much for action.

Do you want the complete image on profits, income and cash flow for the company? Then our free Human technology report will help you enlighten its historical performance.

Is there enough growth in income planned for human technology?

There is an inherent assumption that a company should surpass industry for P/ S ratios such as human technologies to be considered reasonable.

Looking back first, we see that the company managed to increase the 11% income at hand last year. In the end, however, he could not reverse the poor performance of the previous period, with revenues down 8.5% in total in the past three years. Unfortunately, we must recognize that the company did not do an excellent job of growing income during this period.

Unlike the company, the rest of the industry is expected to increase by 41% over the next year, which really makes the recent decrease in the company’s medium -term income.

In this spirit, we find it worrying that the P / S of human technology exceeds that of its peers in industry. Apparently, many investors of the company are much more optimistic than the last times indicate and are not willing to abandon their actions at all costs. There is a very good chance that existing shareholders are preparing for a future disappointment if P / S falls more at levels in accordance with recent negative growth rates.

What can we learn from the P / S of human technology?

There is still a certain elevation in the p / s of human technology, even if the same thing cannot be said for its course in action recently. It is argued that the price / sale ratio is a lower measurement of value in certain industries, but it can be a powerful indicator of feeling of business.

We have established that human technology is currently negotiating on a much higher P / S since its recent incomes were decreasing in the medium term. Currently, we are not comfortable with the high P / S, because this income performance is very unlikely to support such a positive feeling for a long time. Unless the circumstances surrounding the recent improve in the medium term, it would not be wrong to expect a difficult period to come for the shareholders of society.

That said, be aware Human technology shows 3 warning panels In our investment analysis, and 1 of them should not be ignored.

If companies have solid growth in past profits are in your alleyYou may want to see this free Collection of other companies with strong growth in profits and low P/ E ratios.

If you are looking to exchange Human technologyOpen an account with the least expensive platform that trusts professionals, Interactive brokers.

With customers in more than 200 countries and territories, and access to 160 markets, IBKR allows you to negotiate actions, options, term contracts, Forex, obligations and funds from a single integrated account.

Take advantage of no hidden fees, no minimum account and conversion rates FX as low as 0.03%, much better than most brokers offer.

Sponsored contents

The evaluation is complex, but we are here to simplify it.

Find out if human technology can be undervalued or overvalued with our detailed analysis, with Estimates of fair value, potential risks, dividends, exchanges of initiates and its financial situation.

Do you have comments on this article? Concerned about content? Get in touch With us directly. Alternatively, send an e-mail to the editorial (AT) simply.

This article by simply Wall St is general. We provide comments based on historical data and analysts forecasts only using an impartial methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to purchase or sell stock and do not take into account your objectives or your financial situation. We aim to provide you with a long -term targeted analysis drawn by fundamental data. Note that our analysis may not take into account the latest ads of the company sensitive to prices or qualitative equipment. Simply Wall St has no position in the actions mentioned.