Many Americans continue entrepreneurship as a way to make a secondary income, Become their own boss and even create a lasting heritage.

However, the start of your own business can have high starting costs, and all locations are not just as ideal for business owners. A new Simplify LLC report ranked states by most of them and the cheapest to start a business in 2025.

Why it matters

Small businesses are facing increased pressure as president Donald Trump Takes prices on Canadian, Mexican and Chinese imports.

The prices, which, according to the Trump administration, aim to limit illegal immigration and drug trafficking, are likely to increase costs for owners of small businesses in particular, because they often operate on thin margins.

What to know

More Americans are launching their own business than ever, the American census recording new commercial requests has increased 59% in the past five years compared to 2015 to 2019.

However, the affordability to start your own business can vary considerably depending on the location.

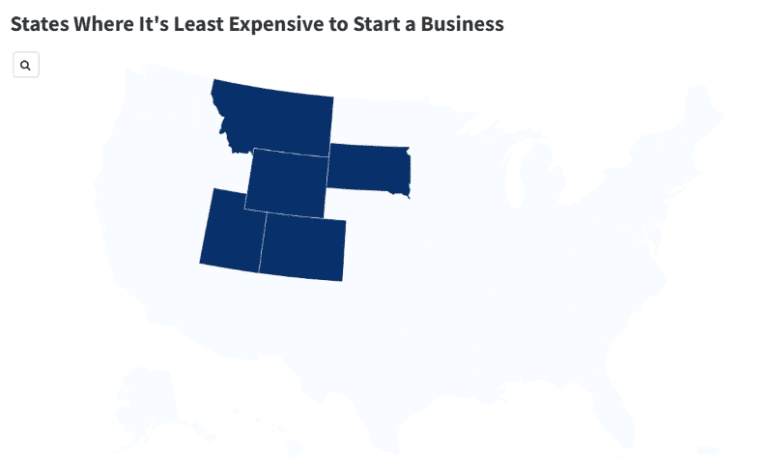

The 10 cheapest states to start your own business were in the West or Midwest, because the region is less likely to have corporate owners’ income taxes. There are fewer regulations and lower costs to start an LLC.

Utah took first place for the cheapest states to start a business. The rate of participation in the active population was high at 68.3% (n ° 4) and its income tax of companies was only 4.65%, or n ° 14 in the country.

Behind UTAH, the list of the five main states cheaper was southern Dakota, Colorado, Wyoming and Montana.

The rest of the states in the top 10 included Idaho, Nebraska, Kansas, Nevada and Northern Dakota.

On the other hand, California was the most expensive state to start a business, because entrepreneurs face a huge regulation of 420,434, the highest in the country. Average wages are also raised at $ 87,490, and corporate income tax is set at 8.84%.

The next two most expensive states to start a business were New York and Hawaii.

The study analyzed the complete costs of starting a company by considering the tax rates of companies and the costs of deposit of companies as well as the costs and the availability of the workforce higher through the State.

Average annual income could increase the workers’ wages and costs for business owners. The average commercial electricity bill and rent could also create other financial difficulties if business owners choose to open a brick and mortar office or a retail space in this state.

Dominik Bindl / Getty Images

What people say

Alex Benee, instructor of financial literacy for the University of Tennessee in Martin, said Nowsweek:: “I think that the biggest surprises on the list come from the southeast of the United States. States like Alabama, Tennessee and Louisiana have become more attractive to employers during the pandemic as places for new facilities due to less restrictive policies, the decrease in the cost of life and more growth opportunities. Although there are many advantages to these states Perspective, tax incentives, it is fascinating to see them so strongly from the perspective of the start-up.

Michael Ryan, an expert in finance and founder of Michaelryanoney.com, said Nowsweek:: “The most affordable states such as UTAH, southern Dakota and Colorado share certain features that make them paradise to businesses.

What happens next

Electricity costs and rent prices will continue to make entrepreneurship more difficult in certain states at high cost, according to experts.

“What should entrepreneurs consider?” It is these sneaky operational costs that add up day after day. Like electricity, wages, rent. And each state has its own regulatory whims. “