When you are the largest bowling operator in the world, and you fresh a brand change a little over two months ago, Lucky Strike Entertainment (CHANCE)Formerly Bowlero, worked to stand at the top of the job. To this end, he highlighted new interesting offers to make customers come back and pay a lot of money to throw heavy plastic balls on a polished lane with several pins. Investors are concerned, however, and the shares have dropped by almost 4% in the trade on Wednesday afternoon.

Discover the best actions and maximize your wallet:

Lucky Strike deploys several new features to keep interest, a vital point at a time when people pinch money to be able to afford eggs for breakfast, among many other invoices that have not fallen simply because the president Asset has been in power for a little over a month. New technology offers accelerate the order processes to allow people to quickly take advantage of fries and cocktails, and new food choices such as “crisp shrimp breads” are a new spark on things.

However, surprisingly, Lucky Strike throws all this at a time when he travels his books in search of budget cuts. Lucky Strike discovered that the reduction in air conditioning overnight has saved “tens of millions of dollars”, but has not damaged the customer experience. At the end of his fiscal year, this summer, Lucky Strike hopes to prevent around $ 40 million in capital expenses, while spending $ 50 million in improvements.

Basic positive

It may seem a strange game, but the reports suggest that Lucky Strike’s operations are doing better than some people think. In fact, reports note that food and drinks alone represent 37% of lucky strike income. These new crisp shrimp breads could be able to pick up even more things, offering “premium options” in a place that is not exactly known for them.

We also know that Lucky Strike recently picked up the Wave Raging Wave Park, a movement that could see more lucky strike places appear in these places. Lucky Strike probably knows the limits in which he works and works to deploy more options accordingly to capture what it can from a discretionary market a little under fire at the moment.

Is Lucky Strike Stock a good purchase right now?

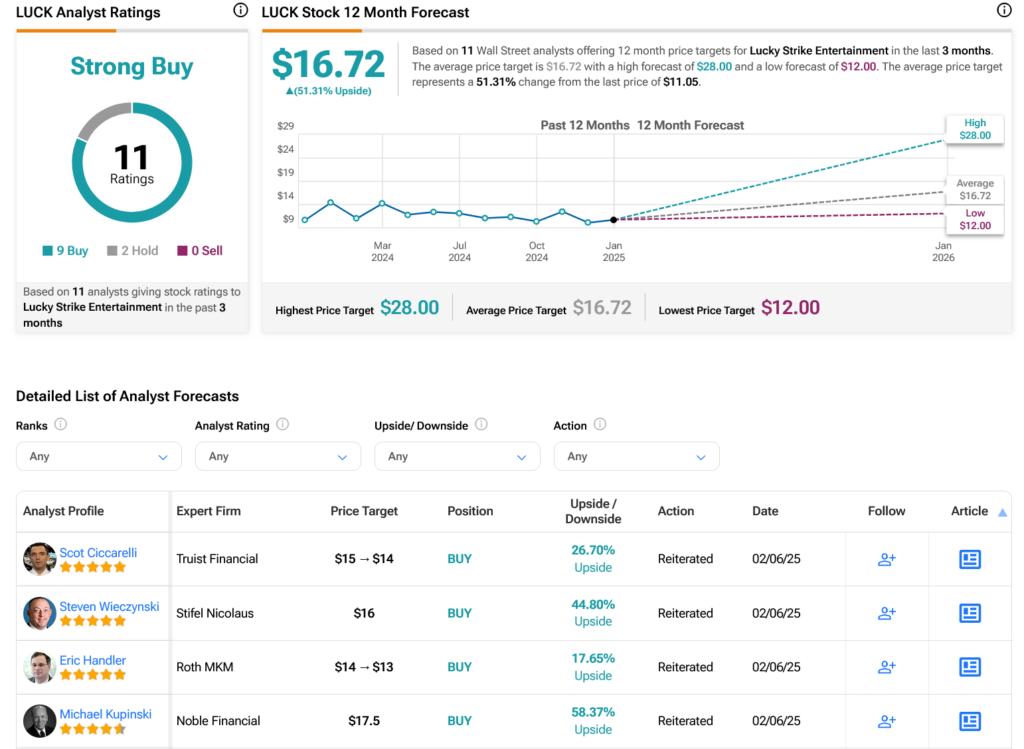

Turning to Wall Street, analysts have a strong purchase consensus rating on lucky stock on the basis of nine purchases and two doses allocated in the last three months, as indicated by the graph below. After 12.30% Loss in its share of action During the last year, the Average chance price objective From $ 16.72 per share implies an increase of increase of 51.31%.