By figures

Fourth quarter renus: $ 6.4 billion

Increase of 10.7% from one year to the next

2024 income: $ 22.6 billion

Increase of 10.2% from one year to the next

Fourth quarter man managed: $ 546 million

52.2% decrease from one year to the next

2024 Net managed: $ 2.99 billion

5.4% decrease from one year to the next

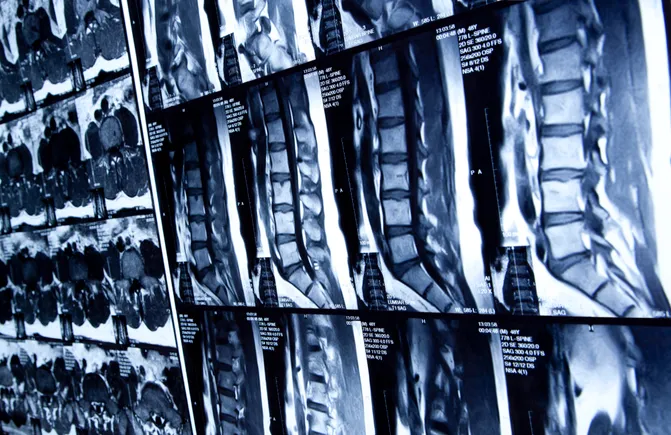

Stryker has reached an agreement with the Viscogliosi Brothers family investment company in Sell its American activities of vertebral implants For an undisclosed amount, companies announced on Tuesday.

The newly formed company will be called VB Spine, specializing in Neuro-Musculosqueletto products. The agreement includes a binding offer to acquire Stryker’s vertebral products in France.

Stryker CEO Kevin Lobo told investors on Tuesday that the segment “was faced with challenges in carrying out our performance expectations”. Lobo added that sales will put the business in the hands of new owners with a large experience on the spine market and allowed Stryker to better align its resources.

Stryker reported a good will and other disabilities of $ 818 million linked to the spine sector in the fourth quarter. Stryker Spinal Implants’ activities reported $ 707 million Sales in 2024And Lobo said that “the entire $ 700 million should be sold to (VB spine)”.

Lobo stressed that Stryker is still interested in interventional products from the spine, including its Q orientation system for planning and surgical navigation, and its Mako spine robot. Stryker Received the customs clearance of Food and Drug Administration For Mako Spine in August and provides for a complete commercial launch of the United States in the second half, said Andy Pierce, president of the medical surgery and neurotechnology group.

VB Spine will have exclusive access to Mako Spine and Copilot for use with the implants of the VB spine in column procedures. Copilot is a feature To help place the screw during surgery by stopping automatically when a planned depth is reached.

In addition, Stryker plans to sell its activities of spine implants on other international markets.

New CFO

The financial director Glenn Boehnlein, who has been working at Stryker for 22 years, will retire. Preston Wells, who is currently a financial director of the Stryker Orthopedist group, will become the new CFO of the company from April 1.

“Glenn is a champion of growth that has invested in the development of talents, notably Preston Wells, who was promoted to financial director,” Lobo said in a statement.

Wells has been working at Stryker since 2016 in management positions, including the vice-president of investors relations and the vice-president of financial planning analysis, according to his LinkedIn page. Before that, Wells was the financial director of the LED lighting company Diallt and occupied senior financial roles at Johnson & Johnson.

Inari update

Stryker also used Tuesday’s call to provide an update on his 4.9 billion dollars planned for inari medicalThis manufactures mechanical thrombectomy systems to treat vascular diseases. Companies expect the agreement to end at the end of February, said Boehnlein. Inari is expected to bring in $ 590 million in constant currency sales during the 10 months ending in December 2025.

Pierce said that the acquisition would make Stryker a fast -growing market leader in the treatment of mechanical thromboembolia (TEV) mechanical thromboembolia, a condition where blood clots are formed in the veins. Inari is currently selling its devices on more than 30 markets, and Stryker expects the acquisition to help to increase its international presence.

Stryker considers mechanical thrombectomy for the TEV as a total market of $ 15 billion worldwide, with the United States representing nearly $ 6 billion in this opportunity, Pierce said.